Candlestick Patterns: Decoding Market Sentiments in Financial Trading

0

0

Posted: Mon March 11 1:34 PM PDT

Member: Sintia Derthy

Have you ever stared at a financial chart, feeling like it's a puzzle waiting to be solved? Candlestick patterns, the building blocks of many a trader's toolkit, are like hieroglyphs of the finance world. They tell stories of battles between bulls and bears, of sudden turns and quiet steadiness. In this deep dive, we're not just scratching the surface; we're going to unlock the tales these candlesticks tell and how they reflect the very pulse of the market.

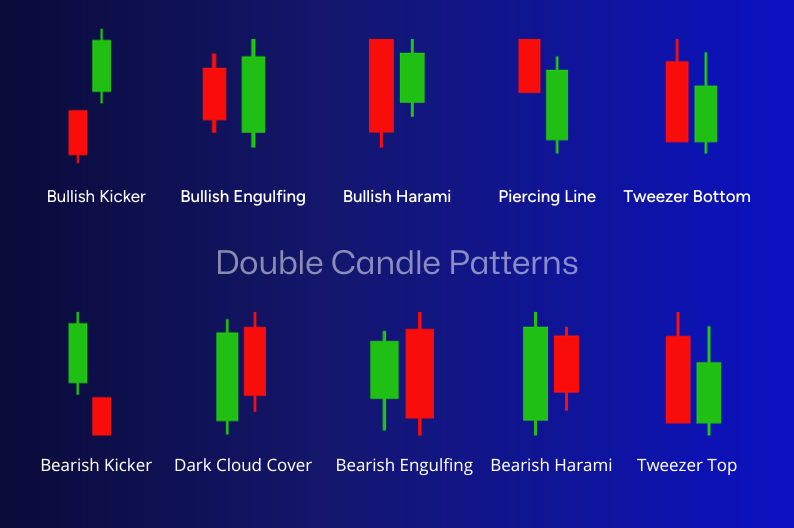

The Essence of Candlestick Patterns

In the dance of the financial markets, candlestick patterns are the rhythm. They are not just lines and curves on a chart; they are the DNA of market sentiment. Born in Japan over centuries ago, these patterns are now a universal language in trading.

Each candlestick is a story of its own, a 24-hour tale of struggle and triumph. The body of the candle reveals the opening and closing prices, while the wicks, those thin lines, whisper about highs and lows. It's like reading a daily diary of the market's mood swings.

Why Candlesticks Matter

Why bother with candlesticks, you ask? Imagine them as the market's heartbeat, showing the vigor of the buyers or the resolve of the sellers. A single candlestick can be a fluke, but put together, they weave a tale of market trends, of potential reversals, or of indecision among traders.

For those diving into the market, understanding these patterns is like having a secret map. It's not about crystal-ball gazing; it's about informed predictions based on historical behavior.

Twin Peaks: The Equal Open-Close Candlesticks

Now, picture this: two candlesticks standing side by side, their bodies almost identical in height. The closing price of one is the opening price of the next. It's like the market took a breath, paused, unsure of its next step.

These twins, especially with their wicks pointing upwards, are more than just a pretty pattern. They hint at a tug-of-war, a balance of power between those pushing the price up and those pulling it down.

Market Sentiment and Candlestick Interpretation

Candlesticks are the market's way of talking to us. When you see a candlestick with a long upper wick and a small body, the market is telling you a story of a rally that lost steam. It's like the market saying, "I tried to climb, but something held me back."

Interpreting these signals is both an art and a science. It's not just about the shapes; it's about the context, the volume, the market conditions. This interpretation is what separates the seasoned traders from the novices.

Practical Application in Trading Strategies

Now, how do you use this knowledge in real-life trading? It's about strategy, about having a plan. Candlestick patterns can be your guide, a part of your toolkit for making informed decisions. For a deeper understanding, you can explore https://fxci.com/candlestick-patterns-basics/, which offers detailed insights into these patterns.

But remember, candlesticks are not standalone signals. They are a piece of the puzzle, to be used alongside other indicators. It's like getting different pieces of advice before making a big decision.

Conclusion

So, there you have it: a journey into the world of candlestick patterns. They are not just charts; they are stories, emotions, hints of the market's future moves. Understanding these patterns is a step towards mastering the art of trading, a way to tune into the market's rhythm.

Remember, trading is a journey, not a destination. It's about learning, adapting, and staying curious. And in this journey, candlestick patterns are your companions, whispering the market's secrets, one candle at a time.

Comments

Please login above to comment.