What is the BRRRR Strategy?

0

0

Posted: Wed November 02 10:41 AM PDT

Business: My Business Name

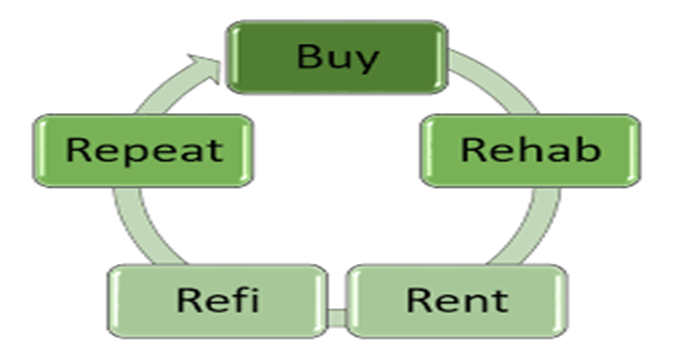

What is the BRRRR approach?

The BRRRR method is an acronym used to describe an Investment Strategy that is popular that is used in Real Estate to buy a property, and then eventually be the owner of the asset, with only a small amount in your personal money to invest. To understand this strategy, we'll use an example of a four unit property.

What is BRRRR refer to?

● BUY

● RENOVATE

● RENT

● REFINANCE

● REPEAT

Let's look at each letter in detail.

Buy

This is where you'll need to purchase a property, however, not just any property. The property you wish to purchase is likely to be priced below the market value. The reason is that you'll want to boost the value of the property once you've got to the remodeling phase of the plan. For our instance of the four unit property, we'll assume that the property is in a rough state and receiving rent that is below market of $800 for each room, which means that the property earns $3,200 per month. Also, let's consider that the fixed cost of selling the house is $750k. Because it's not rented and in need of repairs, we'll be able to purchase this home for $500,000.

Renovate

You're looking to make smart renovations to your property which will save money while also adding a unique flavor to the property. The kitchen is the most important area to focus on flooring, flooring and paint are cheap methods to boost the worth of the home. Let's suppose you spend $25k on each unit, that's you'll spend $100k on renovations.

Rent

If you now have four gorgeously renovated units, you'll have to rent each unit at market rents. We'll also assume that market rents will be $1,400 for each unit, which means that the total gross profit on this property will be $5,600. If you're deciding to rent you must be able to identify the applicants because it's very easy to get them to make false claims on applications. You should get the following information from them:

The company's employment - phone to confirm that they're employed by the company.

Credit report

Background Check

References

Refinance

Now that you own an entirely renovated property and all four units are paying market rent, you are planning to take it to the bank and appraise the property. Let's say that you decide to do this and the appraisal results at $700k in the amount you anticipated. The lender will grant you a loan as high as 80 percent of the current value, which is $560k. Let's take note of the total expenses we are paying for the property are the following:

Purchase Price- $500k

Closing Costs- $15k

Renovations- $50k

All costs included of $565k

If the bank will provide you with a new mortgage of $560k, you'll use that amount to take out $560k from the previous expenses of $565k, leaving the remaining $5k.

Let's suppose your costs are in the following order:

New mortgage: $2650

Taxes: $300

Insurance: $300

Utilities: $500

Other: $300

Total All In: $4,050

Total Income: $5,600

Total cost total: $4,050

Total CashFlow: $1,550

This means that you have this property to yourself for just $5k in your own money, and you earn an average of $1550 per month in passive income.

Repeat

Once you have the capital that you originally invested back, and you are able to continue the process of purchasing more properties with it. This is how generational wealth can be created.

Comments

Please login above to comment.